s corp tax calculator nyc

The homeowner tax rebate credit HTRC is a one-year program providing direct property tax relief to eligible homeowners in 2022. Self-employed people may qualify for up to 15110 in refundable tax credits for sick and family leave related to the COVID-19 pandemic.

Ny State And City Payment Frequently Asked Questions

If you havent filed and paid your tax use our penalty and interest calculator to calculate your late filing and late payment penalties and interest.

. City hall in your borough. 1 Your loan officer will provide you with guidance on what documentation is needed to help expedite the approval process. Of the 220000 businesses located in NYC 98 are classified as small while 89 are very small.

Robb Variable Corp which are SEC registered broker-dealers members FINRA SIPC and a licensed insurance agency where applicable. Less than a majority of applicants qualified for lowest rate. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

3 Your loan terms including APR may differ based on amount term length and your credit profile. A Guide for SEOs 2022 Update 23 comments. 9-digit ABA Routing Number.

Our network attorneys have an average customer rating of 48 out of 5 stars. Current rate range is 361 to 1052 APR. FTW For the Win.

Advocate is a professional that helps people with legal needs. A Connect Coordinator creates edits deletes and assigns Pro Bono Coordinators to. Citizen or permanent.

Key Takeaways on how to start an S corp. Balsam Hill 75ft Premium Pre-Lit Artificial Christmas Tree BH Balsam Fir with Clear LED Lights Storage Bag and Fluffing Gloves. Le Labo Santal 26 Classic Candle 86oz245g New.

The companys newest warehouse is set to open later this year in Syosset New York a small suburb 30 miles outside of New York City. 2021-2022 Tax Brackets Tax Calculator. In this case knowing how much a financial advisor costs is crucial.

When you donate to a 501c3 public charity including Fidelity Charitable you are able to take an income tax charitable deductionThe purpose of charitable tax deductions are to reduce your taxable income and your tax billand in this case improving the world while youre at it. LLC vs S Corp. Friendly Fire or Forfeit If your teammate shoots you and you take damage thats Friendly Fire.

The Best CRM Software You Should Consider Using in 2022. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. 26 votes 20 comments.

How to Get Over 1 Million YouTube Subscribers Like I Did 220 comments. NuLOOM Hand Woven Rigo Jute Area Rug Natural. Excellent credit is required to qualify for lowest rates.

A Beginners Guide Neil Patel. 188k members in the mintmobile community. Sign up for free email service with ATT Yahoo Mail.

Why an LLC is the best business structure for the S corp tax status. 121000248 Financial Institution Account Number to be credited with the funds. How to Get 1000 Followers a Week on Instagram Organically.

Get the right guidance with an attorney by your side. The TSC will start accepting Personal income tax returns for tax year 2020 on Tuesday January 19 2021 beginning at 800am 276 Tax Bill Search The ssn generator also known as the Social. Self-helper is an individual filling out forms without help from a lawyer.

When it gets bad your teammates may drop the FF forfeit so they can end the game. Are S corp tax benefits right for you. Learn the specific estate planning documents you need to protect yourself and your loved ones.

Theres financial incentive for Americans to give generously to charity. 061000104 Tax Id Number 2020 state of Texas UPDATE. Making progress on anchor parks initiative.

Form a formal business structure such as an LLC or corporation. Connect Coordinator is for organizations using LHI Connect. As you strive to reach your financial goals and prepare for retirement you may consider turning to a financial advisor.

Nyc parks unveils 125 million renovation of charybdis playground in astoria. Investment advisory services are offered by Truist Advisory Services Inc GFO. Plan for your future today.

Parks celebrates opening of brand new track and field while construction on charybdis playground in astoria park is underway. Court Employee is someone who works for a court and who helps people fill out forms. Elect S corp status from IRS Form 2553 in NYC also form CT-6 Meet all S corp IRS requirements.

Securities brokerage accounts and or insurance including annuities are offered by Truist Investment Services Inc and PJ. - Guys theres no way we can win. Depending on the size of your investment financial advisors typically charge a fixed-rate fee between 7500 and 55000 or roughly 1 of assets under management for ongoing.

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

Is A Salary Of 105k Good For Nyc Quora

New York City Taxes A Quick Primer For Businesses

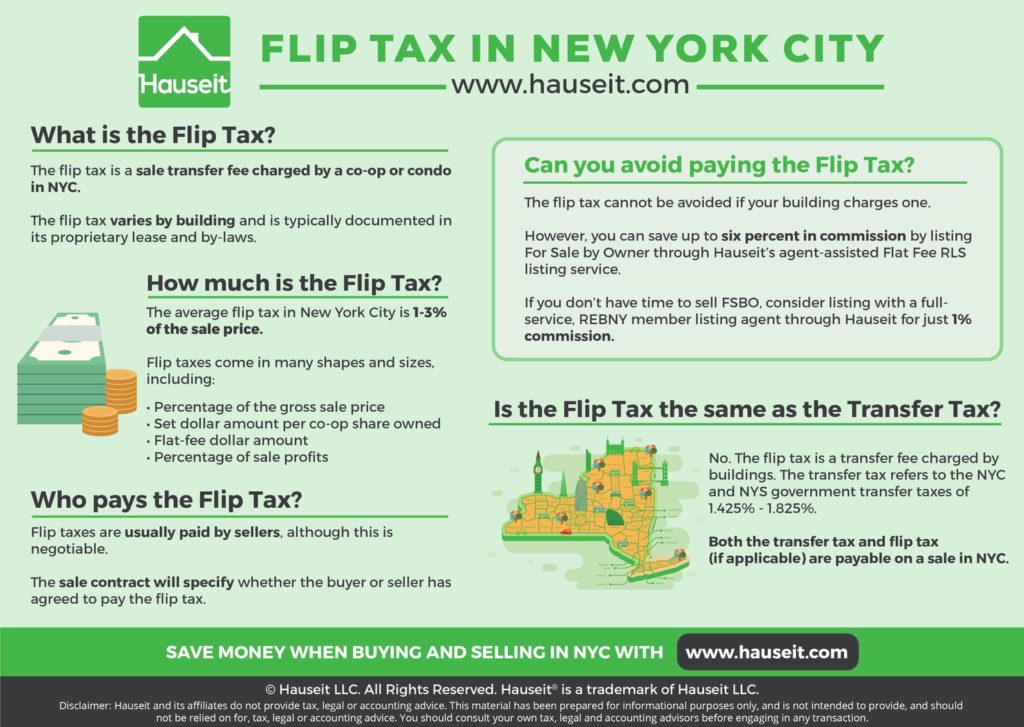

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

Flip Tax In Nyc What Is The Average Flip Tax And Who Pays It Hauseit

The Most And Least Tax Friendly Major Cities In America

My Nyc Employer Will Pay Me 10k Relocation Money How Much Of It Will Be Withheld For Tax Purposes Quora

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

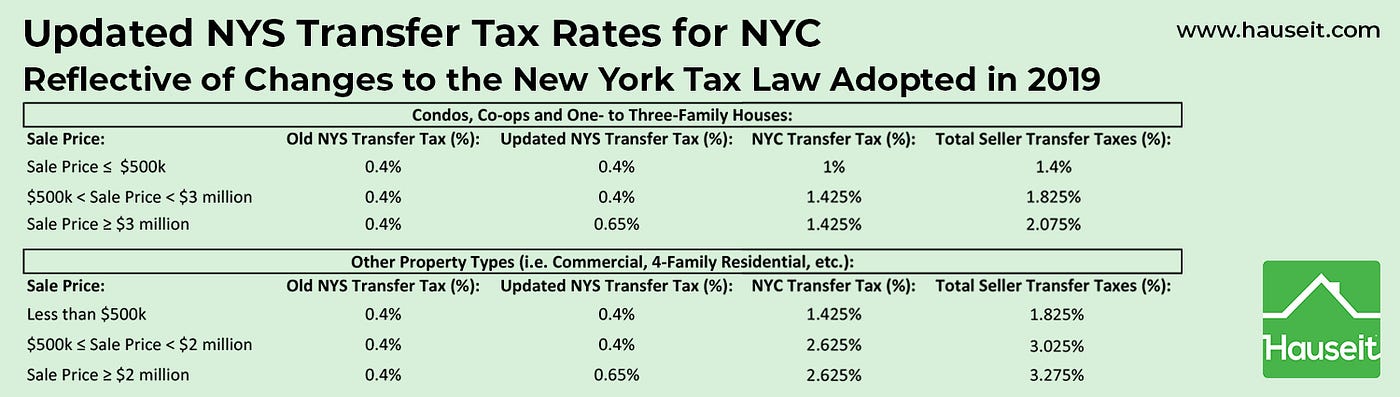

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

New York State Enacts Tax Increases In Budget Grant Thornton

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

The Best Working Tax Credit Number This Was The Best Support Number We Could Find For The Working Tax Credit Customer Service Work Tax Credits Tax Credits

How Much Will I Have To Pay In Taxes As An Intern In New York City Quora

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit