does south dakota have sales tax on vehicles

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. 45 South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6.

States Where You Ll Pay The Lowest Property And Vehicle Taxes Marketwatch

The excise tax which you pay on vehicles in South Dakota is only 4.

. The sd sales tax applicable to the sale of cars. Alaska Arkansas Iowa Minnesota Montana South Carolina and South Dakota. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The state sales tax rate in South Dakota is 4500. South Dakota sales tax and use tax rates are 45.

What is the total sales tax rate in South Dakota. What is the sales tax. What is ND sales tax on vehicles.

If you have NEVER paid sales tax they will apply that 4 to the purchase price if. Does South Dakota have vehicle tax. However this does not include any potential local or county.

The South Dakota Department of Revenue administers these taxes. In addition to taxes car purchases in South Dakota may be subject to other fees like registration. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Cars sold in private sales in South Dakota are still subject to the car sales tax of 4. However the buyer will have to. In addition for a car purchased in South Dakota.

Does South Dakota Have Sales Tax On Vehicles. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. South Dakotas taxes on vehicle purchases are applied to the sale price before rebates or incentives.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum. What is the South Dakota sales tax rate. Several examples of of items that exempt from South.

The sales tax on a car purchased in North Dakota is 5. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. South dakota does not have a corporate unitary or personal income tax.

Any company that does not have a physical presence in South Dakota is also required by law in South Dakota to get a South Dakota sales tax license and pay the relevant sales tax if it fits. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. What is the sales tax on a car purchased in North Dakota.

However if the vehicle is 11 years or older or is sold for less than 2500 no sales tax is. 5 North Dakota levies a 5 sales tax rate on the purchase of all. Thus a 12000 car may have a 1200 cash rebate.

Cars sold in private. All together there are seven total states that have no required vehicle inspections. Does South Dakota have sales tax on vehicles.

South Dakota Sales Tax Breaks Consumers Pay While Big Businesses Get Exemptions

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

South Dakota Vehicle Registration Vehicle Registration Services Dakotapost

Full Time Travelers Dakotapost

South Dakota Pushes Lower Sales Tax Despite Gov Kristi Noem S Stance

Sales Use Tax South Dakota Department Of Revenue

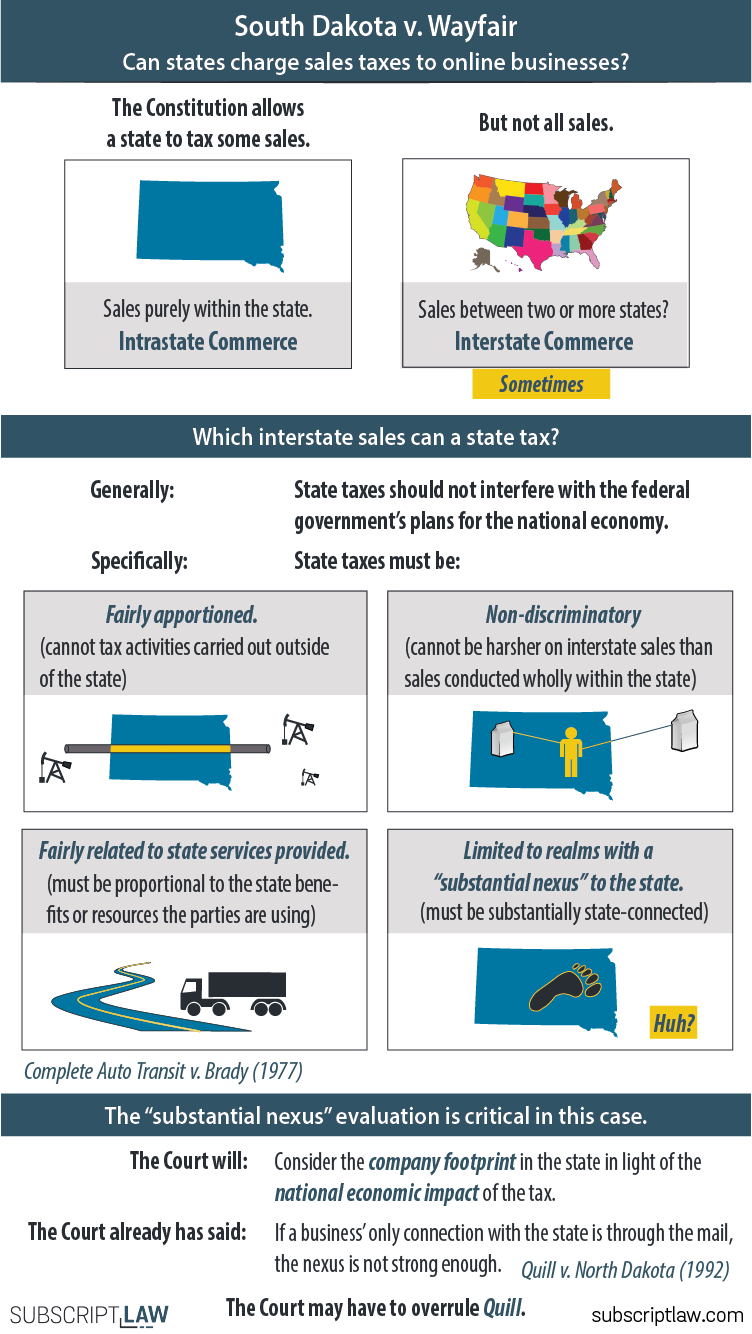

South Dakota V Wayfair Argument April 17 2018 Subscript Law

Bills Of Sale In South Dakota The Forms And Facts You Need

Tangible Personal Property State Tangible Personal Property Taxes

State Local Tax Burden Rankings Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Historical South Dakota Tax Policy Information Ballotpedia

What State Has No Sales Tax On Rvs Rvshare

All Vehicles Title Fees Registration South Dakota Department Of Revenue

South Dakota License Plate Automobile Vehicle Tax Tag 1998 Car Auto Ebay